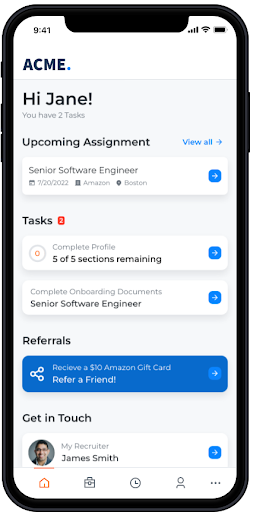

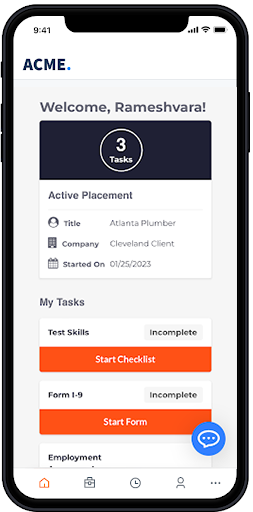

Improve the candidate experience

Give candidates a memorable experience with a mobile-first approach, a single location to track their onboarding requirements, and the least amount of clicks necessary. A great experience up top means happier candidates and fewer no-shows.

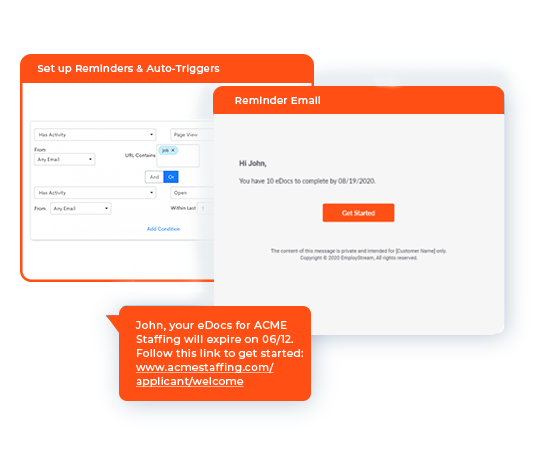

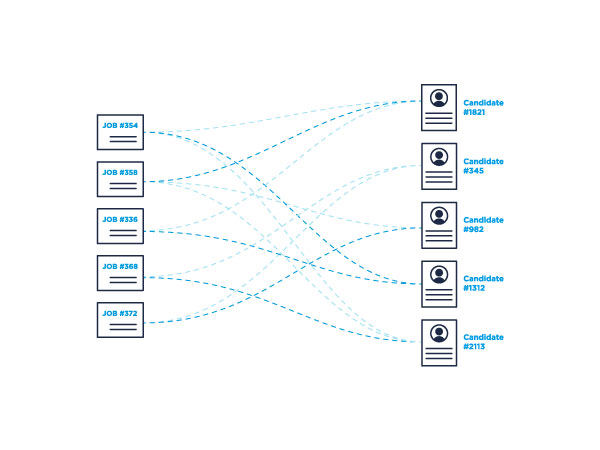

Streamline onboarding operations

Every minute of lost productivity can hurt a business. By automating onboarding and integrating all your key staffing technologies and workflows — your ATS, background checks, e-Verify, etc. — you can streamline the process and ensure you didn’t miss a step.

Become a trusted advisor

Ditch the busywork. Focus on hiring the right people and setting them up for success. Onboarding automation means recruiters make fewer mistakes and have time to build better relationships with candidates and take on more accounts.

Ready to drive better onboarding experiences?

Ready to get started?